Courses

-

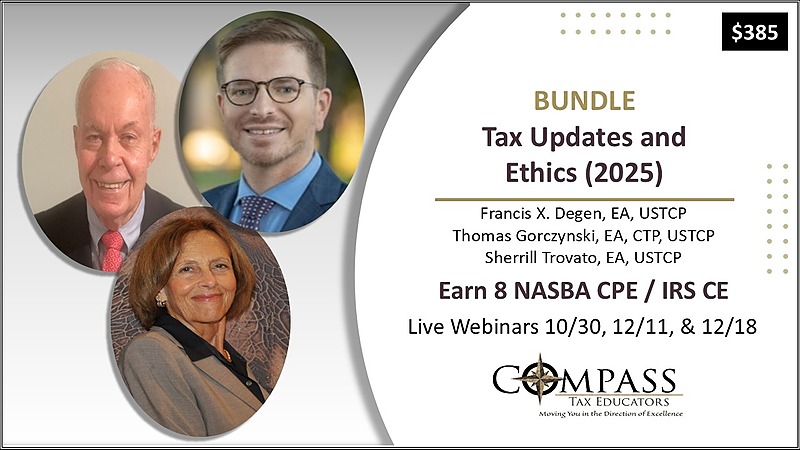

Bundle: 2025 Ethics and Tax Law Updates - Live Webinars

2 CoursesEarn 8 CPE/CE with our popular Ethics and Federal Tax Update classes. These live webinars will take place on 10/30, 12/11, and 12/18.

$385

-

Ethics (2025) - 10/30/25 Live Webinar

This LIVE webinar begins at 2PM ET. Season PASS holders are auto-registered for this event.

$99

-

Making and Changing Entity Classification Elections - 11/13/25 Live Webinar

This LIVE webinar begins at 2PM ET. Season PASS holders are auto-registered for this event.

$99

-

Federal Tax Update (2025) Parts 1 and 2 - 12/11 and 12/18 Live Webinars

These LIVE webinars begin at 2PM ET. Season PASS holders are auto-registered for this event.

$298