Courses

-

2026 PASS - Includes All Live Webinars

13 CoursesThe 2026 PASS provides you with access to attend all live webinars held during the calendar year. Complimentary REPLAY access is provided as well as automatic ON DEMAND enrollment should you miss a live event. 30 CPE/CE + Breaking News events!

$1,399

-

OBBBA in Action: Filing Season Strategies

The tax law provides many different options for how a business entity may be treated for federal tax purposes. This course reviews the possibilities, including how to make any required elections and the tax consequences of making those elections.

$119

-

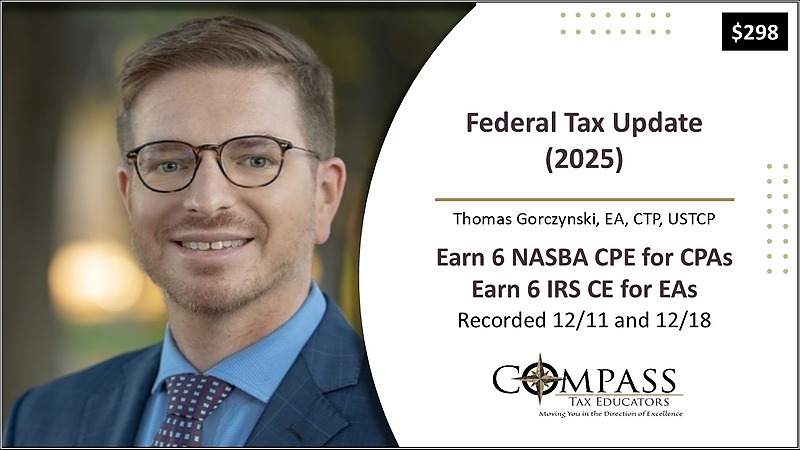

Bundle: 2025 Federal Tax Update On Demand

2 CoursesEarn 6 CPE/CE hours with this 2-Part Federal Tax Update

$298

-

Federal Tax Update (2025) Part 1

This course reviews tax law changes and trends that impact individual and business taxation for 2025, as well as representing taxpayers before the IRS. It also covers best practices for the tax practice and tax planning opportunities.

$298

-

Federal Tax Update (2025) Part 2

This course reviews tax law changes and trends that impact individual and business taxation for 2025, as well as representing taxpayers before the IRS. It also covers best practices for the tax practice and tax planning opportunities.

$298

-

S Corporation Essentials

This class covers the essential elements of S corporations including qualifications and elections, formation and capitalization, operations, basis and Form 7203, tax return preparation, closing the S corporation, S corporation tax cases, and more.

$449